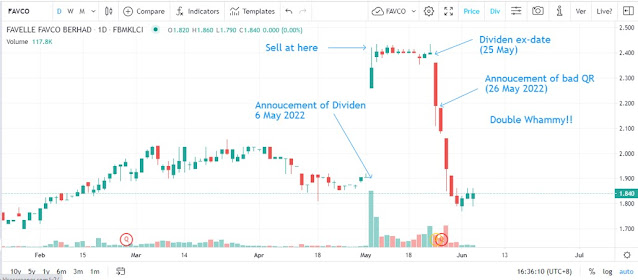

FAVCO announced a whopping 85 cents per share on 6 May 2022. Price shot up to RM3.25 immediately.

Many investors trapped or lose money when buying at high sides @ RM3.25. Here is my view on what we can learn from the this incident. The selling time is important to avoid being trapped.

Motive of Huge Dividen

The motive of such high dividen was very clear. Muhibbah is the biggest shareholder of FAVCO and they are in cash flow problem. FAVCO has huge cash file. So naturally Muhibbah would want to utilize the cash pile from FAVCO. So the huge dividen is to save Muhibbah and not for rewarding shareholders because of good business.

In some cases, huge dividen also can happen if the company sold their core business. For example : SCGM who sold their plastic business to Mitsui Japan.

Share Price

Share price will naturally adjust after ex-date. A lot people do not aware of such incident. Share price also under huge selling pressure after ex-date. In many cases, prices go down FAR MORE THAN DIVIDEN itself. Unless your entry price is supper low or the company businsess will continue to be good, there is not point of holding the shares.

Strategy

I have FAVCO share before the announcement of huge dividen which I could make appox 30% profit. However, I made a mistake of not selling it as I thought it had not reached the profit that I wanted. I also anticipated that business will continue to be good as oil price has recovered to USD100 per barrel. However, the QR was a disappointment. I ended up selling after dividen ex-date and made only small profit overall.

So the lesson is to sell before ex-date or sell half the shares if you anticipated good result or business will be good.

No comments:

Post a Comment