Fundamental :

Company

has no bank borrowing as at 31st December 2020. They have adopted a

dividen policy of distributing 80% of the profit after tax. Revenue is cyclic

as palm oil is commodity.

Q1

Result

Two

major factors are CPO price and Production. I take the conservative 80%

production output from the average of 2020 & 2021. Based on this production

rate, let’s see how the CPO price will affect the earning per share and the

dividen yield.

The

EPS is generated using the formula that developed. It is not 100% but give very

good indication.

CPO

on Downtrend

The

CPO down trend will continue as Indonesia cutting the export duty and putting

more CPO supply to the market. Coming good harvest of Soybean in Latin America

will also help to ease the supply shortage. Hence, I estimate that CPO will

probably drop in between 3000-4000 level.

Based

on this CPO level and dividen yield return, the price to enter is around

RM1.36-RM1.50.

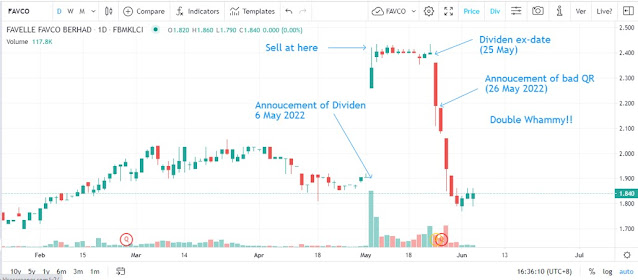

Stock

Price on Down trend

Price

already drops below the support level and will continue to drop. The bearish

continue trend has shown.

At

time of writing, I own some INNOPRISE shares @ low price. Waiting for

opportunity to buy more.