Company : CSC Steel – Short Term Technical Play

Business:

Manufacturing

of Cold Roll Coil (CRC). Very competitive landscape because of foreign dumping from

Korea, Vietnam, India and China. Margin is low, less than 10%!! 2021 is

improving because of higher steel price and China is curbing CO2 emission.

Manufacturing

plant is located in Melaka. The major shareholder is CSC Steel Taiwan. It is a well-managed

company with profit every year except 2014.

The usage of CRC as follows:

- Household appliances : Furniture, lockers,

cabinet filling, hinges, computer cases etc

- Construction : Roofing, garages, steel sheds,

gutter, window frame etc

- Industrial : Tube, scaffolding, steel mesh, drum,

air conditioning ducting etc

- Automotive & Tooling : Tooling, hardware,

machinery, parts etc

Fundamental:

Company

has huge cash pile of RM300 million so no problem to pay dividen every year.

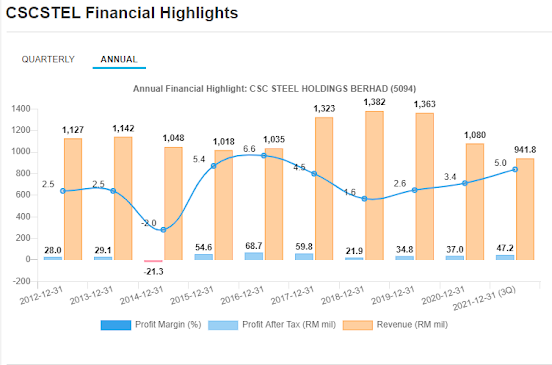

Very low profit margin and no growth in terms of CAGR revenue and PAT.

Revenue stagnant. Forecast revenue for 2021 will be around RM 1.25 billion if Q4 recovers well. The business is largely depending on domestic spending especially construction and industrial activities.

Cost

of sales related:

- Raw material cost of Hot Roll Coil.

- Labour ?

Lates Q3 result:

YoY

and QoQ dropped because of lockdown and factory are not in production.

Hopefully Q4 will recover to RM300 million.

Prospect:

Major Shareholders:

Dividen:

Dividen

policy is 50% of its profit. Assuming 7 cents dividen that will translate to 5%

dividen yield in coming 4 months. There is room for price appreciation of 15-20%

Technical

Analysis on Chart:

No comments:

Post a Comment