Company : Lii Hen Industries Berhad – Big brother in furniture

Industry

Business :

Manufacture

wide range furniture products (office & home) and export to oversea with

North America constituted about 91% of the revenue. The factories are located

in Muar and Tangkak districts. Company also planting rubber trees in Johor.

Company is the clear leader in Malaysia furniture industry.

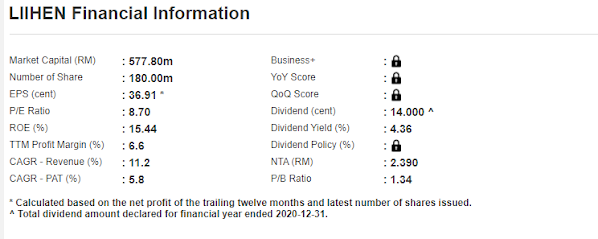

Fundamental

:

The

company has net cash of RM160 million (2020 report) and pay dividen every

quarter. Strong cash flow as products are exported oversea. Company is

profitable every year and revenue are increasing steadily from 2016 to 2020. It

is definitely a growth company. However, 2021 revenue will drop due to MCO

lockdowns.

5 years revenue

There

is clear sign of growth revenue from 216 to 2020. Probably due to trade-war

between China and USA. Both CAGR- revenue and PAT are showing growth.

Geography

break down of the revenue for 2020 is as follow.

Their

customers are US furniture importers, wholesalers and retailers. Company is a clear

beneficiary from USA-China trade war and has established strong foothold in NA

market.

Cost

of sales

Two major

costs are raw material and labour cost.

Lates

result at glance :

The

Q2 revenue and profit have dropped on YoY and QoQ basis. Primarily due to MCO

shutdowns. It has been 4 quarters on the row that revenue drop. However, company still manage to

chalk up 7.8 million profit despite challenging operating conditions (FMCO and container

shortage).

Comparing

to immediate preceding quarter, revenue and profit also dropped.

Demand

for the products is definitely there but disrupted by pandemic. Company has bought

a piece of land for expansion according to their 2019 annual report.

Risk

Shut

down:

It

is very clear that shutdown during FMCO has caused the revenue to drop. If

not wrong operation is only allowed on 17th August 2021, so there is

7 weeks shut down in Q3. Hence, Q3 result will not be favourable as well.

Raw

material cost:

Certain raw materials like particle, chipboards and carton boxes are on the rise. Hence profit margin will be squeezed

Shipment

cost and container shortage:

Shipment

delay and high container cost. There are total of 18,010 containers ship out in

2020. The increase of freight cost will definitely impact the sales. However,

it is not sure if their sales are on FOB or CIF basis. Global container

shortage is still an issue to company.

Technical

Analysis on Chart:

Price

has been dropping since mid Nov 2020 and bottom at support level RM2.90. Price

then move up to RM3.21.

Forecast

EPS & price

|

Date |

27 August 2021 |

Current Price |

RM3.21 |

||

|

EPS |

|||||

|

Quarter |

Q1 |

Q2 |

Q3 |

Q4 |

Total |

|

Forecast |

6.79 |

4.36 |

2 |

5 |

18.15 |

|

Actual |

6.79 |

4.36 |

|

|

|