Company : Syarikat

Takaful Malaysia Keluarga Berhad

Business

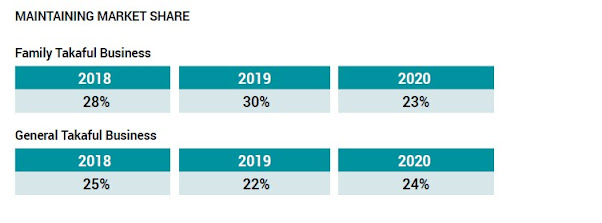

: Insurance business breakdown to family Takaful (life + medical) and general

Takaful (fire, motor, travel etc). Company also has business in Indonesia but Malaysia is still the largest contributor.

Clear

growth of CAGR for revenue and PAT. PE of 8.35 is fair although some peers have

lower PE.

Clear trend of growth and disrupted in 2020 due to COVID. However, 2021 seems picking up again.

Revenue

Split:

The revenue split between family and general takaful is approx. 70% to 30%. Under General Takaful motor is the largest contributor of 66%.

|

Company |

AIG |

LPI |

TAKAFUL |

|

Price (RM) |

13 |

13 |

3.7 |

|

PE |

4.8 |

15.18 |

8.35 |

|

Revenue (latest FY) |

5.9B |

1.6B |

2.9B |

|

Profit Margin (%) |

7.7 |

21.4 |

11.7 |

|

CAGR Revenue |

5.6 |

4.8 |

10.6 |

|

CAGR PAT |

11 |

1 |

18.4 |

|

Dividen Yield |

4.80% |

5.15% |

3% |

|

ROE (%) |

11.57 |

17.97 |

21.94 |

|

(Efficiency to generate profit) |

|||

|

Dividen payment |

Yes |

Yes |

Yes |

|

Nos shares (million) |

177.51 |

398.38 |

835.62 |

Comparison

on potential 30% share price appreciation:

|

Company |

Allianz |

LPI |

Takaful |

|

Current price |

13.04 |

13.98 |

3.66 |

|

30% appreciation |

16.95 |

18.17 |

4.76 |

|

Peak price |

16 |

17 |

7 |

Generally

lower due to COVID lockdown.

Prospect:

- Recovery play

- Capturing mass market & civil servants

(leading position)

- Islamic insurance gaining popularity

- Digitalize marketing and online distribution

Risk:

- More death claims and surrender of policy

(effects from Covid)

- Indonesia business affected.

Dividen

every year end. Dividen yield is around 3% but pay only once a year.

Technical

Analysis on Chart:

On

the down trend due to heavy dumping from EPF. There is no clear sign of support

at this moment. Price is actually very attractive.

At

time of writing, I don’t have any Takaful shares yet but planning to make an entry.