Company : FAVELLE FAVCO – Benefit from Rising Oil

Price?

Business:

Manufacture cranes and intelligent automation for Oil & Gas under Exact group. Revenue split is approximately 77% for cranes and 23% for automation. Their business is highly expose to Oil & Gas, shipyard and high rise building. The crane business has foothold in USA, Europe, Middle East and Asia.

Fundamental:

Company

has huge cash pile of over RM300 million so no problem to pay dividen every

year.

Low profit margin and almost no growth in terms of CAGR revenue and PAT. This is partly due to slump of Oil & Gas sector.

Revenue stagnant at around 550 million and profit margin is compressed.

Lates

Q3 result:

PROSPECT

There are few positive things on FAVCO.

- Recovery of Oil price – especially Ukraine-Russia

tension

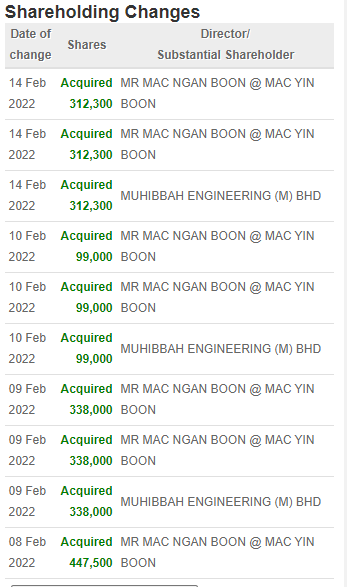

- Shareholder share buy back recently

Revenue

Split

58% of the revenue are generated outside from Malaysia. Automation is 100% from Malaysia.

Dividen:

No

clear dividen policy but it is about 40% and once a year. Hopefully it can go

back to 15 cent which will give 6% yield based on RM2.50

Technical

Analysis on Chart:

Price

does not fluctuate much and possible to go back pre-Covid level of RM2.80 – RM3.00

if Oil & Gas industry recover well.

At time of writing, I have some FAVCO shares.

No comments:

Post a Comment